The Power of Estate Planning With MS

Wills and advance directives give people with MS peace of mind, control over their own care and the means to leave a legacy.

What Is Estate Planning?

Just as there are benefits to having an estate plan, there are consequences for not having one. Although laws vary by state, decisions about your healthcare, finances and property could end up being made by your nearest blood relative — even if you don’t know that person well or have a contentious relationship with them. “This will likely be a close family member, but they may not be the person you would like to make decisions on your behalf,” notes Pippin, who says decisions in some cases might even end up being made by courts or governments.

How to Create an Estate Plan

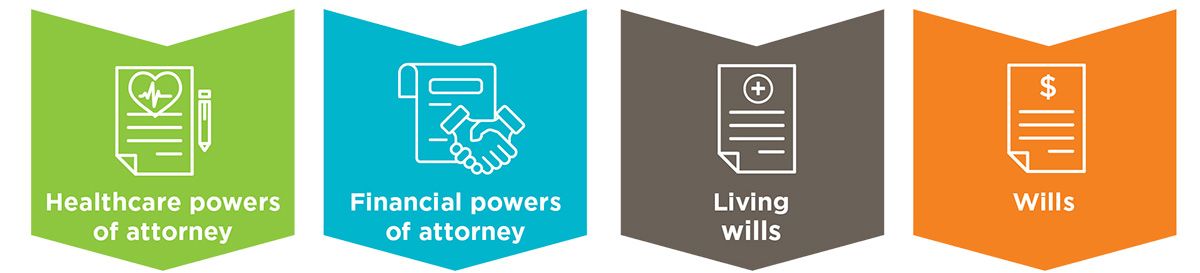

- A healthcare power of attorney is a legal document that names someone to make medical decisions on your behalf if you’re unable to make them for yourself. Known as your “agent,” this person can consult with your doctors, view your medical records, make decisions about treatments and medications, choose where you receive care and decide what to do with your remains if you have not already made plans for them.

- A person granted financial power of attorney can make a wide range of monetary decisions on your behalf. These decisions may encompass:

- Filing taxes

- Selling real estate

- Managing investments and retirement accounts

- Paying bills

- Providing for dependent family members

- A living will allows you to specify your preferences for end-of-life medical care. It may address your priorities (longevity versus quality of life) and whether to withhold life-prolonging procedures. Your living will also may include specific instructions regarding:

- Breathing tubes

- Feeding tubes

- Dialysis machines

- CPR

- A last will and testament outlines how you want your money, property and possessions to be distributed after you die, and names an “executor” to execute your wishes. It might also name guardians for children and pets and could contain instructions for funerals and burials. Assets that have beneficiaries assigned to them — things like life insurance policies, bank accounts and retirement plans — typically are beyond the reach of a will. If you want to control who receives those assets, you must designate a beneficiary directly with the institution that manages them.

Getting Started

Creating these documents is easier than you might think. To start, take inventory of your assets, including your bank accounts, property, investments and personal possessions. Decide where you want those things to go and how you want to divide them up. Your beneficiaries — those who will inherit your assets — can include not only family, friends and neighbors, but also charities and philanthropic organizations like the National Multiple Sclerosis Society.“Who gets your stuff is part of it, but it’s also an opportunity to create a legacy,” Pippin says. “Giving to children and other family members can have a big impact on their life, but you also can have a big impact on causes you care about.”While you’re taking inventory of your assets, also take inventory of your wishes, including who you want to make healthcare and financial decisions for you if you’re incapacitated; what your medical wishes are with regard to things like palliative care, resuscitation, life support and specific medications or treatments that you do or don’t want; who should take care of dependent children and pets when you die; who you want to be the executor of your estate; what you want to happen to your remains; and what your preferences are for your funeral.All of this will form the basis of your estate planning documents.If you have a complicated estate — for example, if you own lots of property, have a business, have complex investments or want to set up your estate in a way that minimizes taxes — an attorney is essential. Most people, however, can draft their advance documents themselves using a low- or no-cost online tool like FreeWill, MyDirectives, Trust & Will or LegalZoom.“People believe they need to go to a lawyer to get advance directives done, but they really don’t,” Brown says.Documents created through the FreeWill platform “are completely legal and valid,” echoes Pippin, although he stresses that digital documents typically need physical signatures in order to be official. “You have to print these documents out and get them signed and witnessed and possibly notarized, depending on where you live,” he says. Although an attorney isn’t required, it’s not a bad idea to have one review your completed documents to make sure they’re correct, he adds.Once your documents are complete, store them somewhere secure yet accessible, like in a home safe; let the important people in your life know that they exist and where they’re located; and share copies with relevant parties, like your doctor, your financial adviser and the executor of your estate.Finally, make sure you revisit your documents regularly to make sure your wishes haven’t changed. “We encourage people to review them at least once a year,” concludes Brown, who says the time to get started is now. “It’s never too late — until it’s too late.”